osceola county property taxes due

Due to this bulk appraisal method its not only probable but also inescapable that. What is the due date for paying property taxes in Osceola county.

Learn how Osceola County levies its real property taxes with our detailed review.

. Any amount remaining unpaid on April 1st is treated as a delinquent tax bill. Search all services we offer. Property taxes are due on September 1.

With our article you will learn important knowledge about Osceola County property taxes and get a better understanding of things to expect when it is time to pay the bill. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get.

Full amount due on property taxes by March 31st. The fall tax payment is due September first and may be paid without penalty on or. Receive 1 discount on payment of real estate and tangible personal property taxes.

Due to Hurricane Ian our office is closed. Each district then gets the assessed amount it levied. Normally the deadline is the last day of the month but this time March 31st falls on a Saturday.

Osceola County collects on. Property taxes may be paid in semi-annual installments due September and March. In Osceola County Florida the median property tax for a home worth 199200 is 1887.

407-742-4037 Property Taxes FAX. The following payment schedule applies to the installment plan. The spring payment was actually due on March 1st but may be paid without penalty by April 2nd.

OSCEOLA COUNTY TAX COLLECTOR. All personal property taxes are payable to the Village of Osceola and due by January 31st of each year. The final 2021-2022 payment is now due if you havent already paid it.

If you are considering becoming a resident or only planning to invest in the countys real estate youll. Local Business Tax Receipts. If you dont pay by the due date you will be charged a penalty and interest.

407-742-4009 Local BusinessTourist Tax. The Amount Payable Online represents all taxes that are payable online for each. Yearly median tax in Osceola County.

The first payment was due in the fall of the year with the last payment due the following spring. There are three primary phases in taxing real estate ie setting mill rates appraising property market worth and taking in tax revenues. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200.

The first payment is due in the fall of the fiscal year with the last payment due the following spring. An owner of eligible property may file a completed summer property tax deferment form with his or her city or township treasurer before September 15th or before the date your summer taxes. 14 the total of estimate.

If you are considering. We will reopen on Monday October 3rd. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist.

407-742-3995 Driver License Tag FAX. Osceola Tax Collector Website. The Tax Collectors Office provides the following services.

The Osceola County Building Department assisted us with this process and we appreciate their support. Irlo Bronson Memorial Hwy. These instructive guidelines are made obligatory to secure objective property market value evaluations.

As part of our commitment to provide citizens with efficient convenient service the. Property taxes in Miami-Dade County are among the highest in Florida with an average of.

Osceola County Fl Property Tax Search And Records Propertyshark

2022 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

![]()

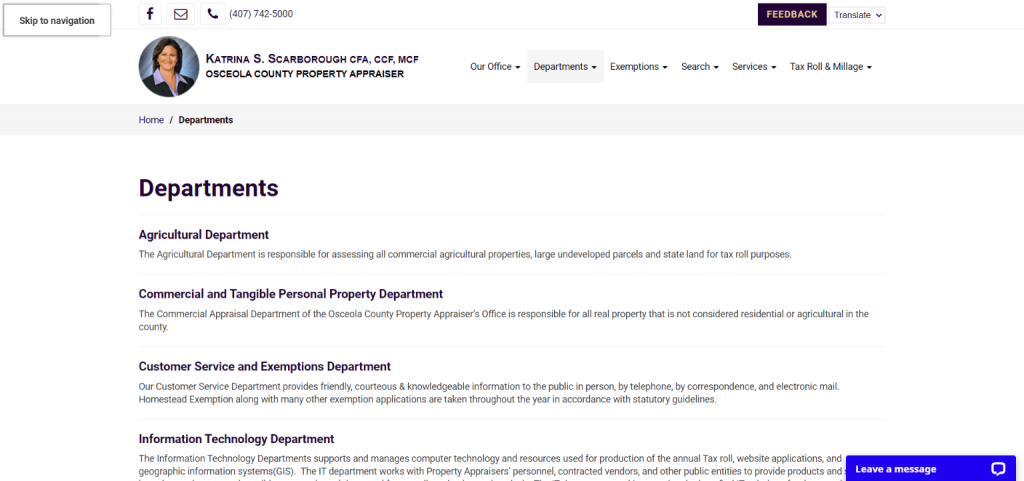

Osceola County Property Appraiser Katrina Scarborough Osceola County Property Appraiser

Ayment Ptions Osceola County Tax Collector

Osceola County Property Appraiser Open Data

Osceola County Florida Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

What Is A Florida County Tourist Development Tax

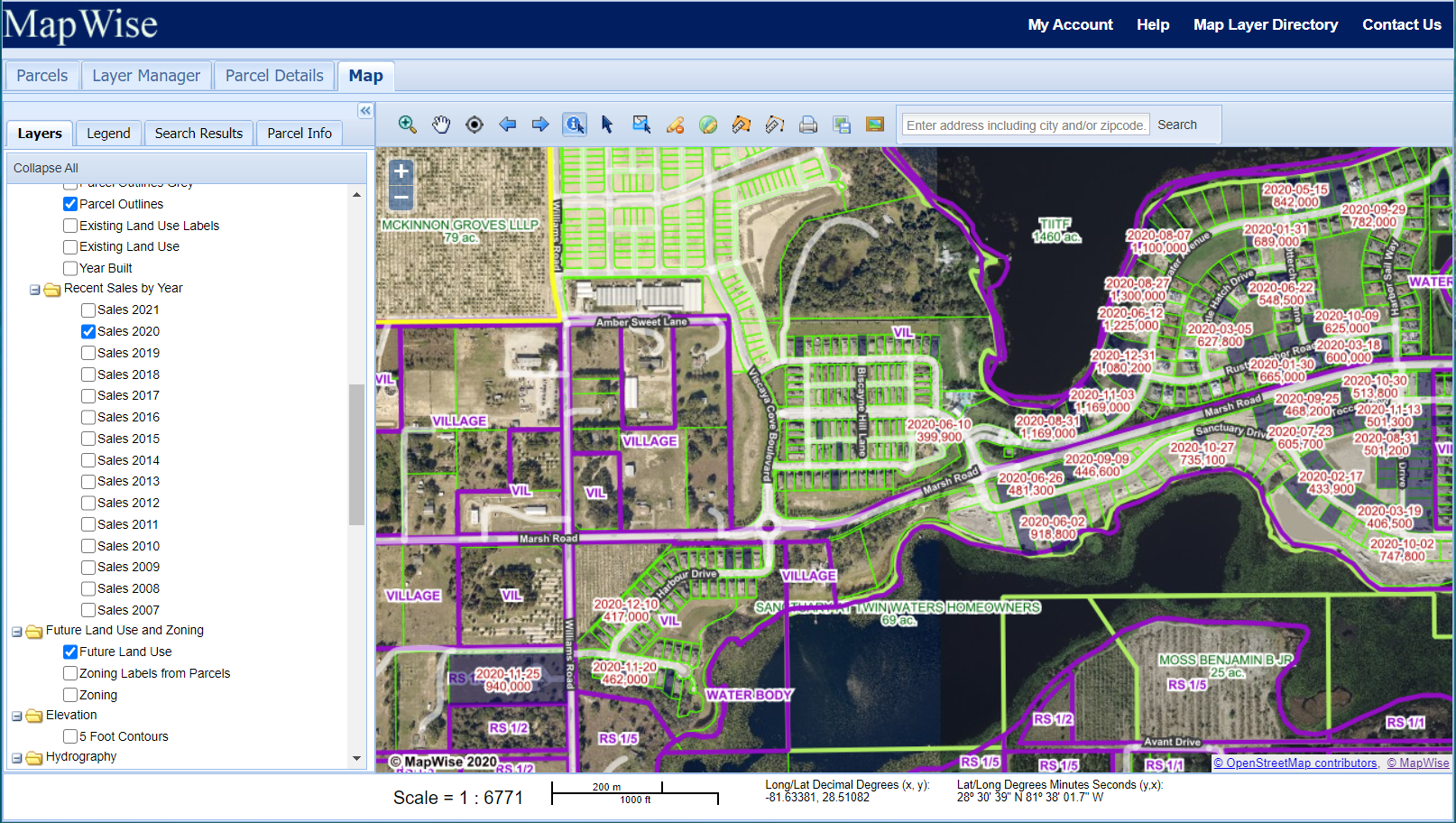

Osceola County Fl Property Search Interactive Gis Map

Florida County Property Appraiser Search Parcel Maps And Data

Florida Property Tax Calculator Smartasset

/cloudfront-us-east-1.images.arcpublishing.com/gray/VFUDJNGHLJDXFEUYGUGPBZGD6I.jpg)

Osceola County Ia Voters To Take Action On Ems Tax Come November

Four New Hotels Coming To Osceola Heritage Park Neocity

How To Pay Osceola County Tourist Tax For Vacation Rentals

2018 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Osceola County Property Appraiser How To Check Your Property S Value

2021 Property Tax Roll Monroe County Tax Collector

Ayment Ptions Osceola County Tax Collector

Osceola County Fl Property Tax Search And Records Propertyshark